A good credit score is an important part of your financial health because it can unlock many savings and benefits. This includes access to loans and credit cards with the most favorable terms. Unfortunately, most people do not think about their credit score often.

In this article, I explore how a good credit score can potentially save you thousands of dollars over a lifetime.

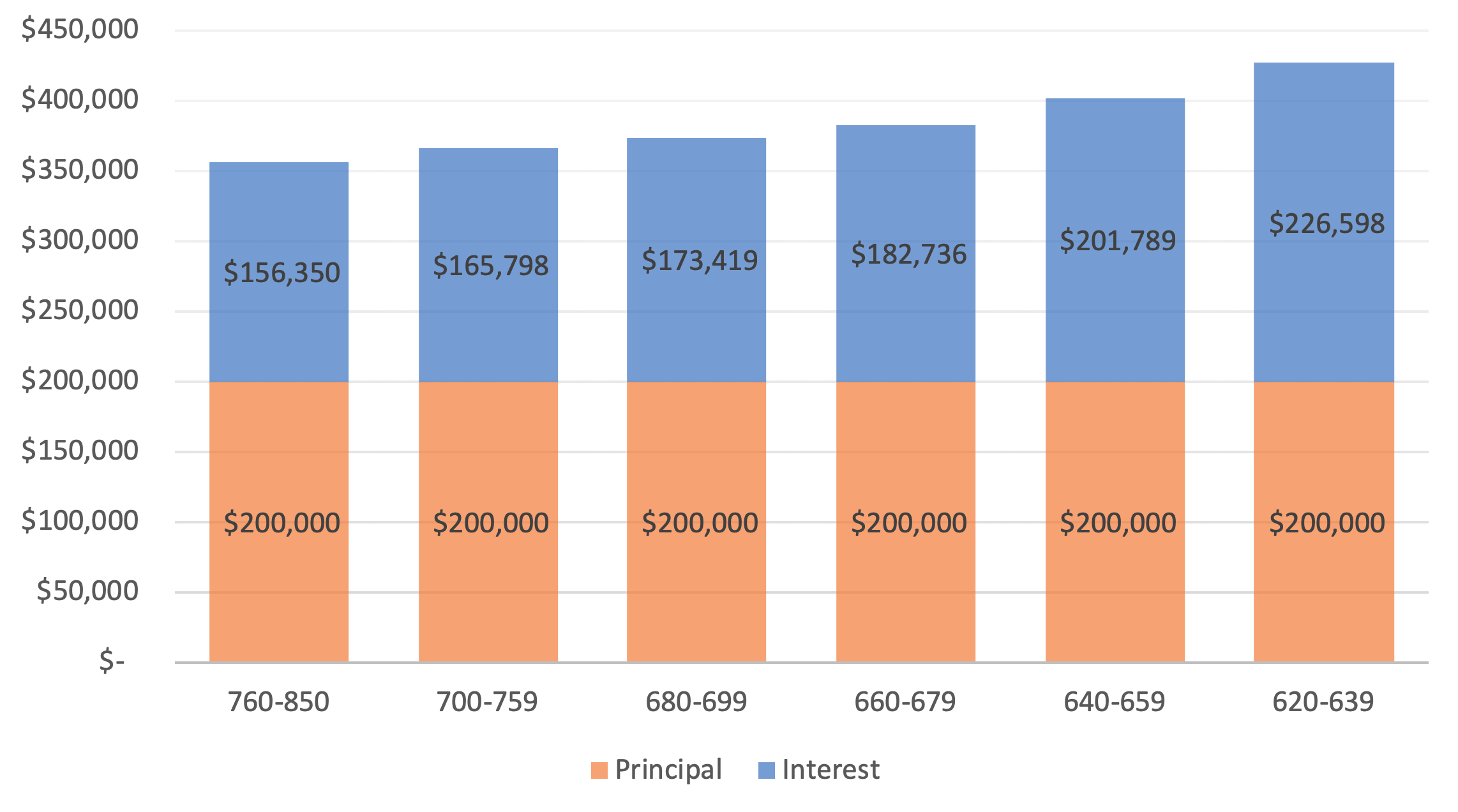

30-Year Fixed Mortgage

Rachel wants to purchase a house for $250,000. She intends to put a down payment of 20% and takes out a 30-year fixed-rate mortgage for the remaining $200,000 balance. Rachel wants to figure out how her credit score affects how much total interest she will pay over the term. She meets with her mortgage broker who provides the following chart.

In this example, the lowest interest rate is 4.301% and the highest interest rate is 5.89%. At first glance, the average person may not think this is a big difference. However, if you compare the total interest paid between the highest and lowest tiers of credit scores there is a large gap. If you have a credit score of 760 or higher, you will save $70,248 over someone who has a credit score below 639.

*Assumes she does not prepay or refinance her mortgage.

** The rates shown are averages based on thousands of financial lenders, conducted daily by Informa Research Services, Inc. The 30-year fixed home mortgage APRs are estimated based on the following assumptions. FICO scores between 620 and 850 (500 and 619) assume a Loan Amount of $150,000, 1.0 (0.0) Points, a Single Family – Owner Occupied Property Type and an 80% (60-80%) Loan-to-Value Ratio.

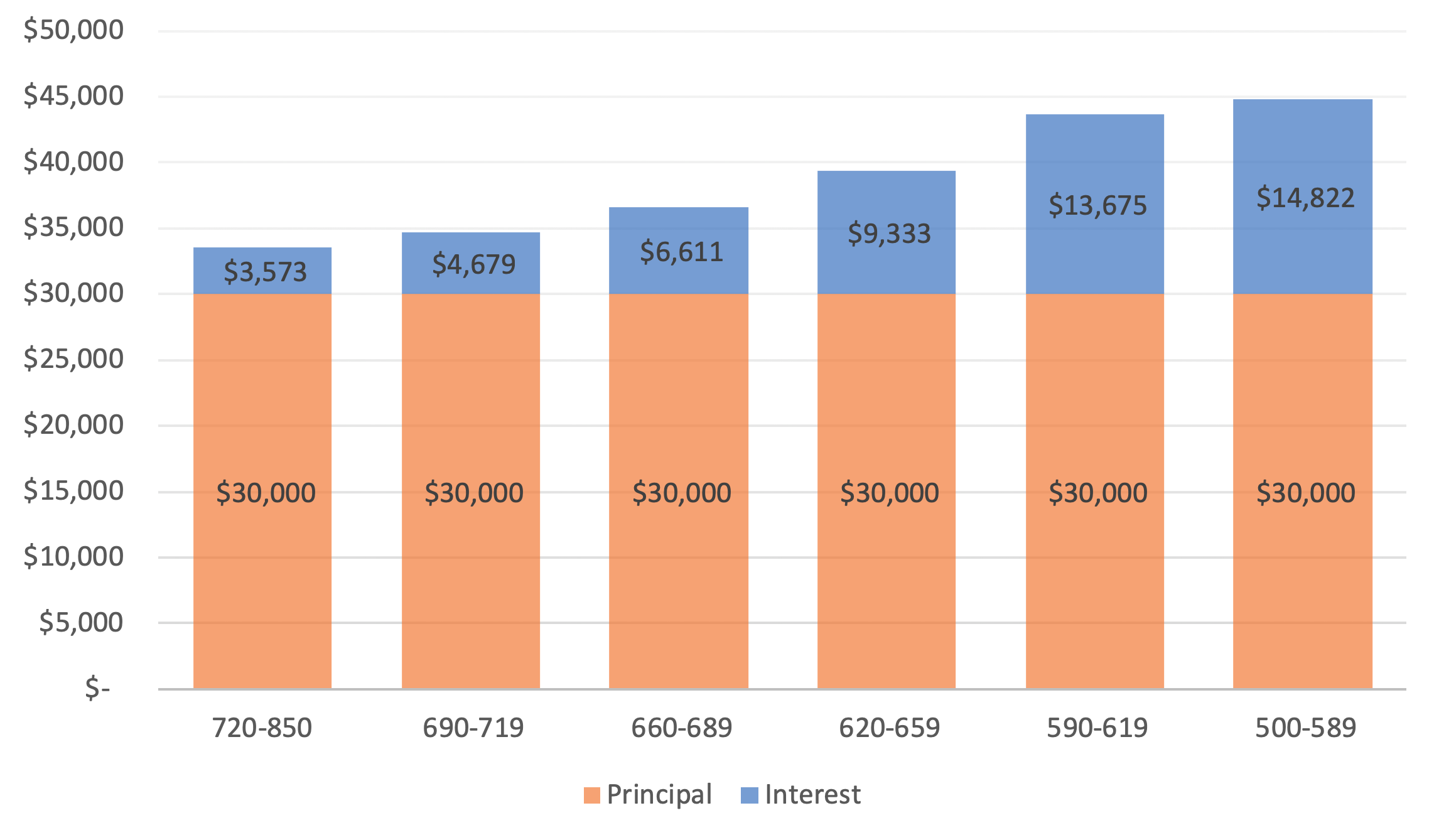

60-Month New Auto

Eric wants to purchase a new car for $30,000. He intends to finance the entire cost of the vehicle over the course of five years. Eric wants to figure out how his credit score affects how much total interest he will pay over the term. He meets with the finance department at the dealership who provides the following chart.

Interest rates on cars loans are much higher than mortgage loans. The lowest interest rate is 4.519% and the highest rate is 17.09%. Therefore, it is advantageous to have a good credit score when purchasing a new car.

* Assumes he does not prepay the auto loan.

** The rates shown are averages based on thousands of financial lenders, conducted daily by Informa Research Services, Inc. The 60-month new auto loan APRs are estimated based on the following assumptions. A Loan Amount between $10,000 and $20,000, 60 months and Interest rates are fixed for the term of the loan. (Variable rate loans may be available but are not usually beneficial to a consumer in a low interest rate environment.)

Conclusion

It is possible to survive with bad credit. However, it is definitely not cheap. I recommend playing around with the myFICO Loan Savings Calculator to approximate how much you might pay in interest.

In a future article, I will talk about how to increase your credit score over time.