I am sure you have heard about the benefits of diversification when it comes to your investment portfolio. You know the expression, “don’t put all your eggs in one basket.”

Conventional wisdom recommends diversifying investment holdings across asset classes in order to mitigate risk. For example, owning mutual funds of hundreds of stocks rather than owning a few individual stocks.

In my opinion, investment diversification alone is not enough to create a well-balanced portfolio. I believe investors must consider the importance of tax diversification. In my experience, it is one of the most underrated financial planning concepts.

What is Tax Diversification?

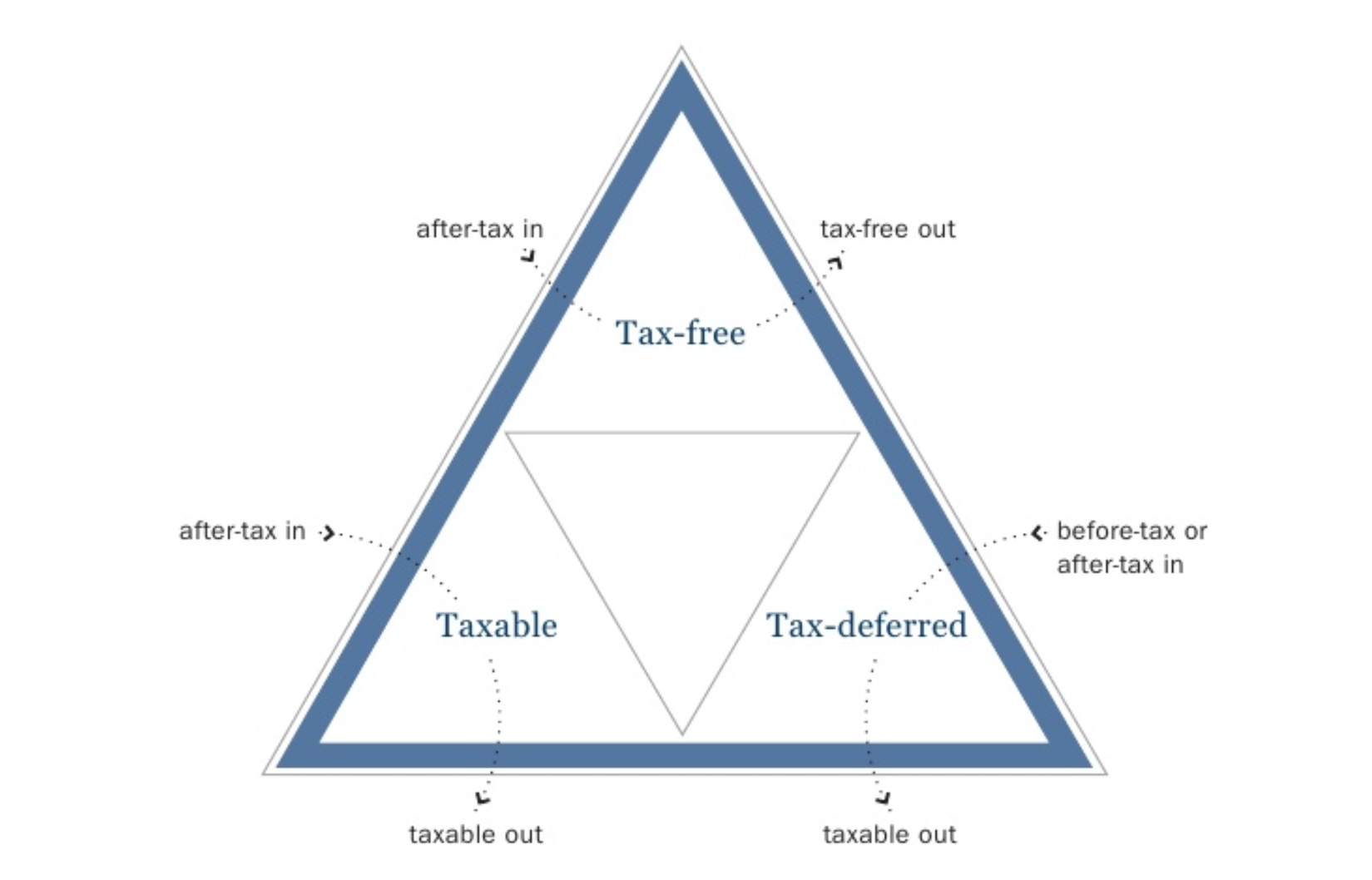

Tax diversification is the strategy of spreading your investments out across each of the different types of account categories.

Most types of accounts fall into four categories. Note, there are many rules, penalties, and exceptions that I do not go over in this account type overview.

Taxable

In a taxable account, you owe income tax annually on any interest or dividends. If you realized a long-term capital gain, you will owe capital gains taxes. For the average person, capital gains taxes are much lower than income tax.

Example Accounts: Individual, Joint, Trust, Estate, Business Account

Tax-Deferred (Pre-Tax Contribution)

In a tax-deferred account, you only owe income tax upon withdrawal/distribution. You do not pay income taxes annually on any interest or dividends. Pre-tax contributions grow entirely tax deferred. When a distribution takes place, you pay income tax on that full distribution.

Example Accounts: 401(k), 403(b), Deductible Traditional IRA, SEP IRA, Simple IRA

Tax-Deferred (After-Tax Contribution)

Similar to the last category. However, contributions to this type of account are after-tax. This means that only investment gains grow tax-deferred and not the principal. When a distribution takes place, you only owe income tax on the gains.

Example Accounts: Non-Deductible Traditional IRA, Non-Qualified Annuities, Withdrawals from Cash Value Life Insurance

Tax-Exempt

In a tax-exempt account, you rarely, if ever, pay income tax. After-tax contribution grow tax free. When a distribution takes place, you will not pay income tax on that distribution.

Example Accounts: Roth IRA, Roth 401(k)

Why Tax Diversification?

When deciding between these types of accounts, you must evaluate how your current tax bracket compares to the tax bracket you expect to be in when you withdraw the money.

From a pure tax perspective, if you expect to be in a higher tax bracket in retirement, it makes sense to put money in a tax-exempt account. If you expect to be in a lower tax bracket in retirement, tax-deferred accounts are a better choice.

Future is Unknown

The most obvious reason for tax diversification is that it is impossible to know what your tax rate will be in retirement, especially if it is years away. This is because your income and the U.S. tax code can change considerably in the long-run.

Liquidity

From a long-term tax savings perspective, taxable accounts may not seem attractive compared to tax-deferred and tax-exempt accounts.

Nevertheless, taxable accounts can be a key part of a well-rounded mix. Taxable accounts provide more flexibility when it comes to covering emergency expenses. Whereas tax-deferred and tax-exempt account have penalties and restrictions depending on your age.

Pretend you have a large one-time expense. Instead of tapping your tax-deferred or tax-exempt accounts, which may subject you to a tax bill or penalty depending on the specific account, you can use the money in your taxable account to cover the expense. Additionally, this allows your tax-deferred and tax-exempt accounts to grow undisturbed.

Sequencing Retirement Distributions

Having multiple types of investment accounts allows you to sequence your retirement distributions.

If you care more about how much tax you will pay while alive, it may be prudent to take distributions from your taxable account first while your tax-deferred and tax-exempt accounts continue to grow.

If you care more about how much tax your estate will pay after you pass away, it might be better to take distributions from your tax-deferred and tax-exempt accounts first. This reason for this is because taxable savings enjoy what is known as a step-up in basis when they are passed to a beneficiary. This means that your beneficiary can potentially sell an inherited asset soon after it is received and owe little or no income tax on it.

Tips

The following are some general tips I tell people who want to diversify the tax liability of their portfolio. Every person has a slightly different financial situation. Additionally, changes in the tax code may alter my tips in the future. Please consult with a financial professional before following any of these steps.

401(k) Match

The highest return you are likely to receive on an investment is an employer match in a 401(k) or other work retirement plan. This is because an employer match is essentially free money. Therefore, it usually makes sense to invest in this type of account first. In my opinion, I would not invest more than what is necessary to get the maximum matching contribution on a yearly basis. The reason I would not invest more in this plan is because workplace retirement plans tend to limit investment choice.

If your employer does not match contributions, it gets trickier. If you are a high income earner who is ineligible to make a pre-tax contribution to a Traditional IRA, it may be worth contributing to your workplace retirement plan anyways.

Roth IRA

Second, assuming your income is below the IRS limits, I would try to contribute the maximum in a Roth IRA. A unique characteristic of Roth IRAs is the ability to take out your contributions at any time. For example, if you contribute $5,500 to a Roth IRA, you are able to take out the lesser of $5,500 or the market value of the account. Note, this ability does not extend to investment earnings.

Although a Roth IRA should serve as a retirement savings vehicle, the flexibility of taking out contributions is helpful. This is because if you take a premature distribution from a tax-deferred account like a 401(k), you will be pay taxes and penalties.

If you expect to become a high earner over the course of your career, I would focus on maxing out Roth IRA contributions while you still can.

If you are ineligible to make a Roth IRA contribution, some workplace retirement plans have a “Roth” option. Unlike a Roth IRA, you will not be able to take out your contributions at any time.

Taxable Account

Third, I would invest in a taxable account. Since this is not a retirement account, there are no contribution limits, income limits, or distribution rules. Although it is taxable, long-term capital gains are taxed at the lower capital gains rate.

What is next?

After you built up a sizable taxable account, you have many options depending on your financial situation. For example, you can contribute more money to your workplace retirement plan up to the maximum allowed for that year. If you have a life insurance need, you can consider cash value insurance that acts as both an insurance policy and a tax deferred (after-tax contribution) investment. Alternatively, you can consider an annuity as a tax-deferred (after-tax contribution) investment.

As mentioned before, please consult with a financial professional before following any of these steps.