In the last article in this series, I went over how fees play a role in the active versus passive debate. Based on experience, I believe many novice investors only consider fees when choosing an investment. Therefore, I think there is a skewed perception on the complexity of this debate.

Although Morningstar’s Active-Passive Barometer report is accurate, it does not consider the full scope of reasons why active funds outperform or underperform the index. For example, their report averages out the performance measures of all active funds regardless of their individual characteristics. In my opinion, an average does not tell the whole story as no two active funds are exactly alike.

In order to provide more context, this article will go over the pros and cons of performance measures. Additionally, I will describe some individual fund characteristics that you should take into account when evaluating active funds.

Market Cycle Performance Measurement

If an investment has strong returns over the last year, do you think it a good investment? What if the returns are strong over three, five, or ten years?

Before answering this, consider the following question:

How many hours are there in single a day?

- 24 hours

- 10 hours

- 5,800 hours

At first glance, you may think 24 hours is the obvious answer. However, depending on your perspective, all are correct. On Earth, there are 24 hours in a single day. On Jupiter, the length of a day is only 10 earth hours which is the shortest amount of time in the solar system. On Venus, the length of one day is 5,800 earth hours which is the longest amount of time in the solar system.

Despite these differences in time, each day on these planets have the same structure (Morning, Afternoon, and Night). Regardless of how long or short a single day is, they will each progress through these three parts as the sun moves through the sky.

Evaluating performance of investments is similar to determining the length of a single day. This is because financial markets are cyclical and each market cycle has defined parts (Bear Market, Recovery, and Bull Market).

When evaluating active funds, it is important to understand that they can perform differently during each part of the market cycle. For example, just as some people might function better in the morning than during the night, some active funds may outperform in bull markets but trail in bear markets. Since a full market cycle incorporates a wide range of environments, it provides context for performance evaluation.

Unfortunately, many investors only evaluate performance on a predefined trailing basis (1 Year, 3 Years, 5 Years, etc.). This is how performance is measured in the Morningstar report. Although trailing performance measures can be helpful, they only provide snapshots in time.

From a typical long-term investor point of view, specific predefined investment measures may not show the whole picture. Therefore, in my opinion, the market cycle performance approach represents actual investor experience.

Active Share

Active share measures the percentage of equity holdings in a fund that differ from the benchmark index.

Higher active share indicates lower holdings similarity between an active mutual fund and a particular index. A fund has a higher active share when it holds stocks that are not in the benchmark, leaves out stocks that are in the benchmark, or holds the same companies as the benchmark but in different weights.

Lower active share indicates that an active fund is a “closet indexer” and copies a specific index. For example, if an active fund has a very low active share, it may underperform the index net of fees.

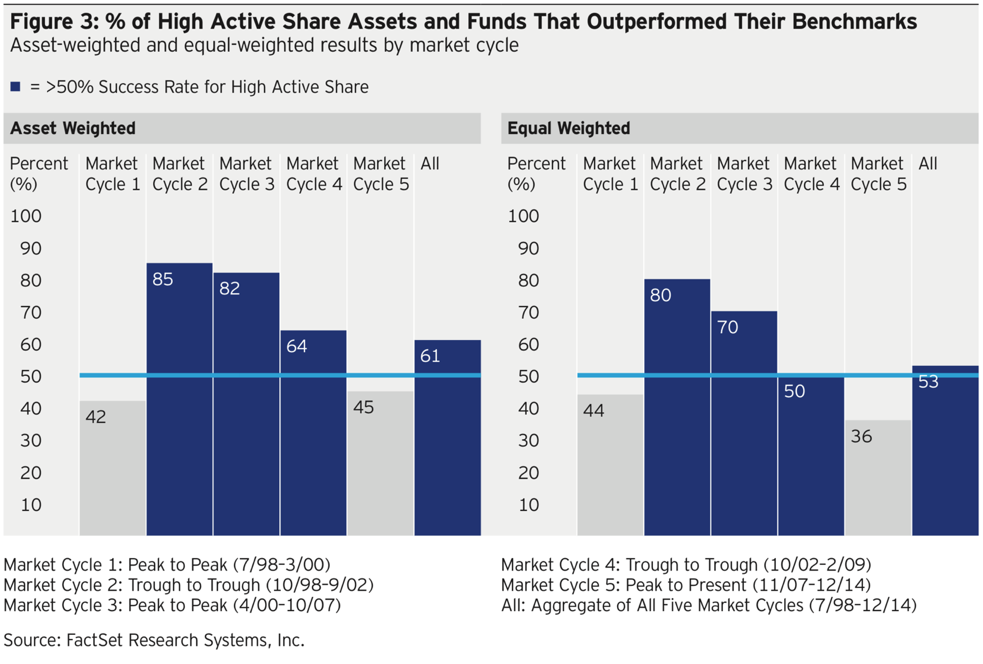

See the chart from their study below.

*Note that asset-weighted average show what percentage of investors’ assets outperformed benchmarks and the equal-weighted average shows the number of actual funds that outperformed. The higher success rate for asset-weighted makes sense because many investors seek out cheaper or better performing funds.

Risk-Adjusted Returns

When it comes to measuring investment performance, only risk-adjusted returns matter. A risk-adjusted return is how much return your investment has made relative to the amount of risk the investment has taken over a given period of time.

Pretend you have two investments. If they both have the same return over a given time period, the one that has the lowest risk will have the better risk adjusted-return.

Since every active mutual fund is unique, understanding this concept is important.

This is because not every active fund has a sole objective of beating the index. For example, some funds take on less risk than the index. Since there is sometimes a correlation between risk and performance, it makes sense that those less risky active funds would underperform the index. Therefore, comparing a less risky fund to the index may not be helpful.

In my opinion, risk-adjusted returns must be evaluated at the investor level to determine which fund is appropriate. Not every investor wants to take on as much risk as the index and vice versa. Thus, the success rate of active funds is not always directly tied with what is suitable for an investor’s portfolio.

Conclusion

In my opinion, relying on averages is a sure-fire method to cover up little differences that might have big meaning. In the context of this debate, an average glosses over the individual characteristics of active funds. This article only scratches the surface.

Additionally, the way investors measure long-term performance can make a big difference. I believe placing too much emphasis on a single predefined statistic only shows one perspective of the debate. This causes investors to not see the big picture.