How many websites do you visit daily? How many of them do you enter login information?

Probably too many to count.

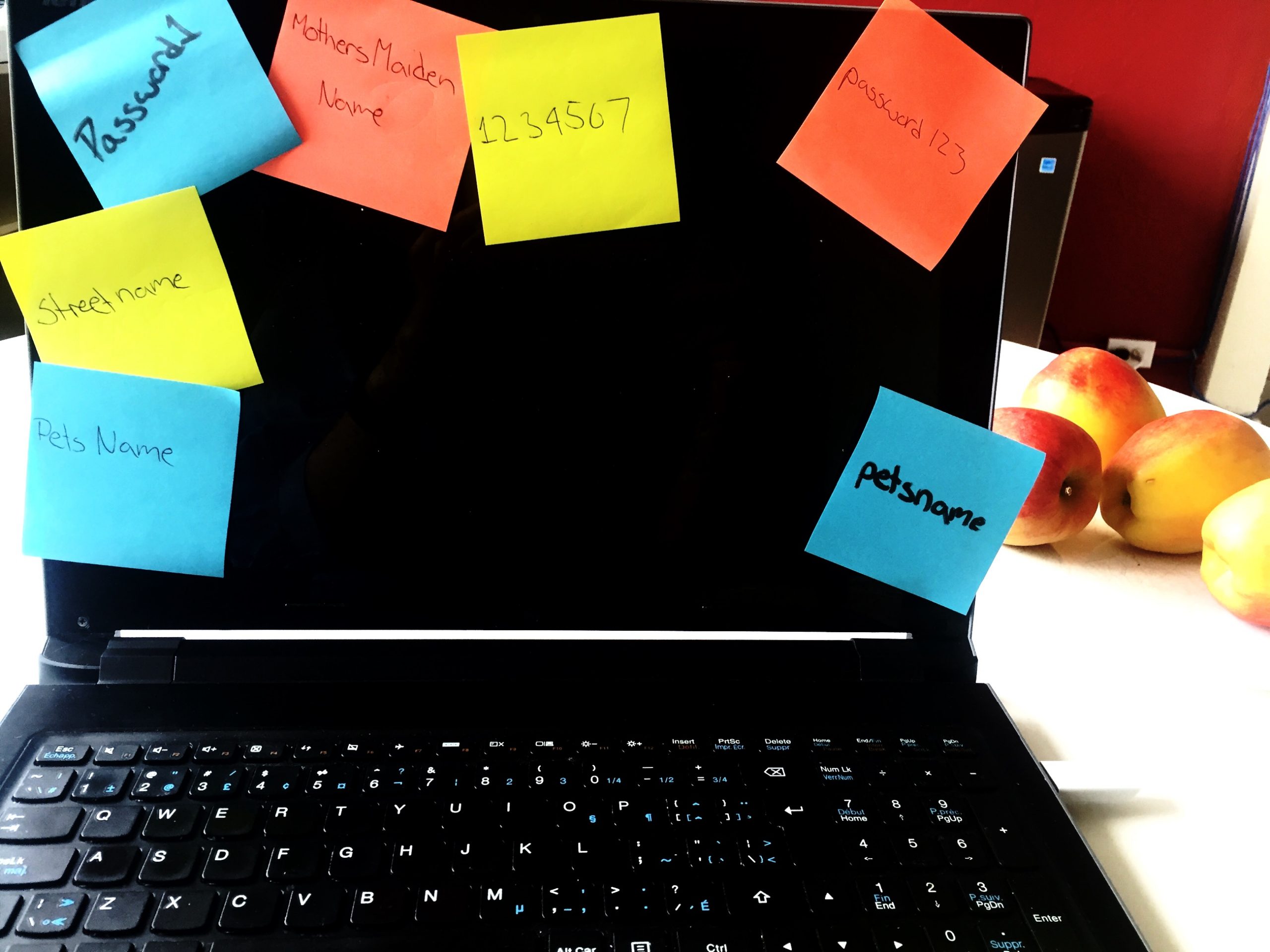

Do you use the same or a similar password on these websites? Is your password your birth date, favorite pet’s name, mother’s maiden name, or some other easily guessed fact about you?

If your answer to any of these questions is yes, then you should consider a password manager.

What is a Password Manager?

Most people use weak passwords (easily guessed passwords) or reuse passwords on multiple websites. Ultimately, this makes one more susceptible to hacking or identity theft.

The best analogy for a password manager is a digital safe that keeps all your passwords secure. It does this by generating a unique complex password when you sign up for a new online account.

In addition, password managers make your life simpler. For example, when you want to login to a website, you authenticate yourself with a preset master password, face scan, or fingerprint. This gets rid of the need to remember multiple passwords.

Some password managers are free and other services are paid subscriptions that include additional features. Also, many password managers integrate with your mobile devices.

Digital Estate Planning

You might be asking yourself, why would a financial planner write a blog post about password management? In my opinion, password management goes hand in hand with digital estate planning.

Everyone has an estate. Your estate comprises of everything you own like your home, car, bank account, investments, life insurance, personal possessions, etc.

People tend to overlook their “digital assets” such as e-mail, social media, cloud storage, etc. In order to access these digital assets, you need a password.

Not only do password managers provide security and ease of use while you are alive, they help the executor of your estate manage your online presence after you pass away.

Some password managers have emergency access kits that would allow the executor of your estate to manage your digital assets. In addition, since password managers keep all your logins in one place, it is easier for the executor to “distribute” your digital belongings per your wishes.

Conclusion

I believe that estate planning is not just for you, it is for the people you love. After you pass away, your loved ones are left to pick up all the pieces.

Having your affairs organized not only helps you with your financial plan, it helps those around you if you are incapacitated or deceased.

For better or worse, our lives have become more digital. Hence, our “digital assets” have some value. In my opinion, a password manager can help organize these assets at every stage of your life.

Please consider your online presence when you develop an estate plan with your financial advisor and attorney.

If you are interested in using a password manager, CNET has a list of their favorite services here.