About Us

Perfect World vs. Reality

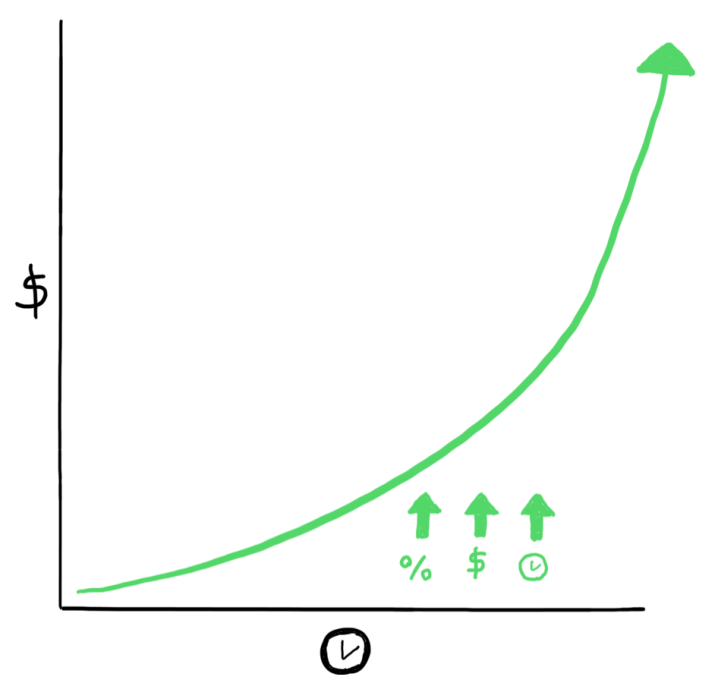

For a moment, imagine you live in a perfect mathematical world.

In this mythical world, your personal wealth curve will grow exponentially if you assume a positive rate of return, periodic contributions, and time.

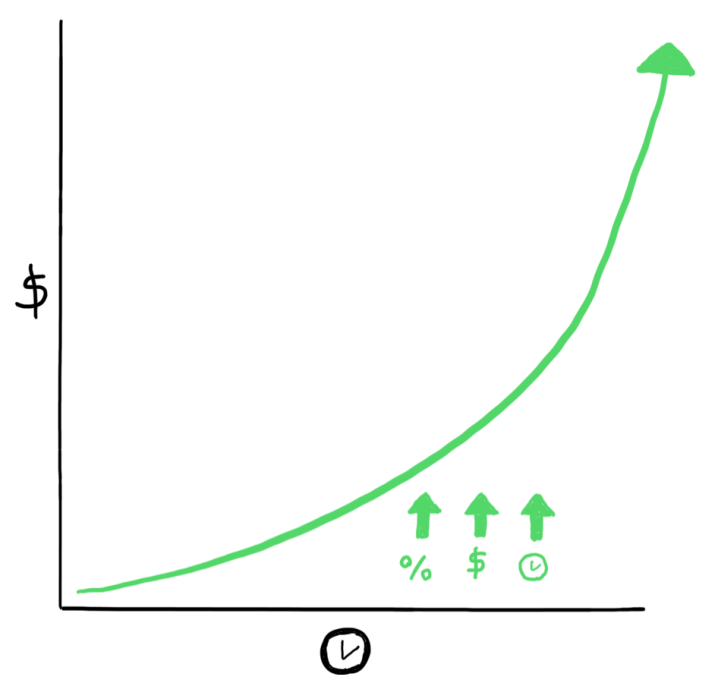

For a moment, imagine you live in a perfect mathematical world.

In this mythical world, your personal wealth curve will grow exponentially if you assume a positive rate of return, periodic contributions, and time.

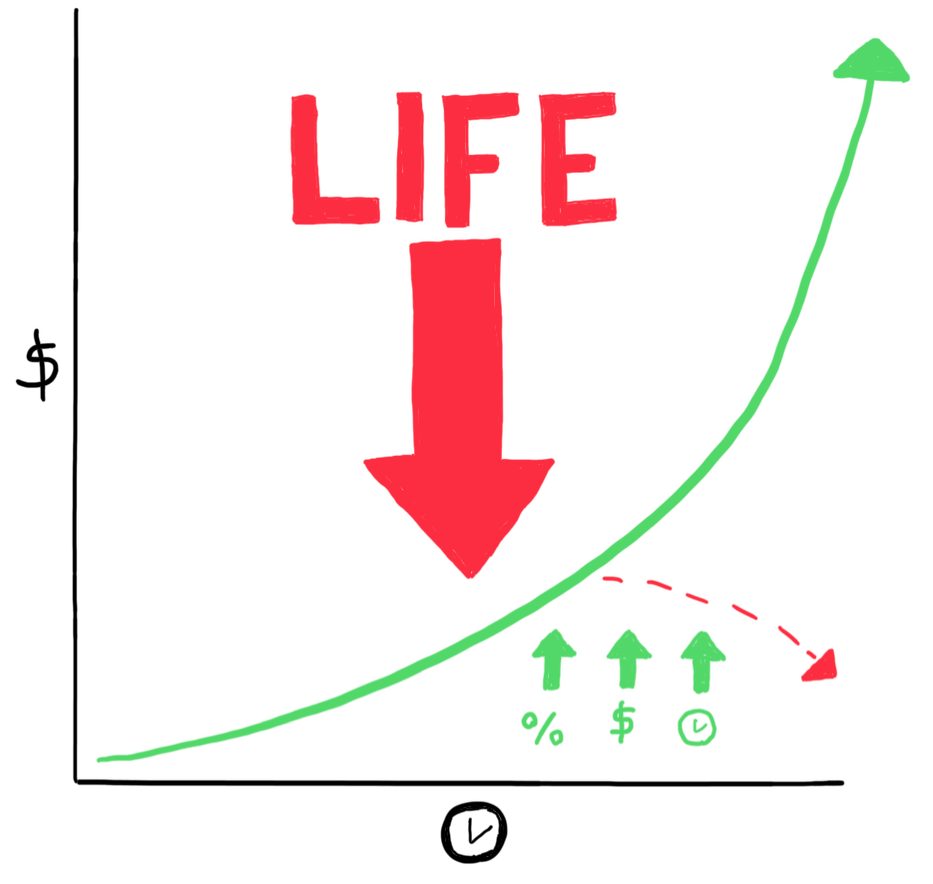

However, in reality, there is a tremendous amount of financial pressure that pushes down on your ability to grow wealth during every stage of life.

Examples of financial pressures include but are not limited to:

- Marriage

- Children

- Divorce

- Illness

- Death

- Debt

- Job Loss

- Career Change

- Aging Parents

- Charitable Giving

- Market Volatility

Our Value Proposition

A good financial plan factors all of these potential pressures. However, it is often difficult for someone to determine the right action steps, let alone recognize their own financial weaknesses.

We help you face these financial pressures by offering five key value propositions.

Organization

We will assist you in making sure that your finances are organized. At the macro level, this may include investments, insurance, retirement planning, etc. At the micro level, this may include cash flow management. Organization provides the framework for establishing a plan to grow your personal wealth curve.

Accountability

We will hold you accountable. A financial plan is meaningless if you do not follow through. We can help you pursue your goals by prioritizing them and providing concrete steps for you to take. Completing these action items provide a path to help grow your personal wealth curve.

Objectivity

We will bring objective insight to help you avoid emotionally driven financial decisions that can negatively impact your wealth curve.

Proactivity

We will work with you to anticipate potential financial pressures and address them when they arise. Failure to think about the big picture ahead of time can negatively impact your wealth curve.

Education

We will empower you to take control of your financial situation and give you the knowledge and confidence to pursue your goals. We strongly believe that knowledge and action are both necessary to maximize your wealth curve.

Our Services

General Planning

- Cash Flow

- Saving Goals

- Debt Managment

- Employee Benefits

- College Funding

Investment Planning

- Stratagies

- Accumulation

- Generating Income

Insurance Planning

- Life & Health

- Disability

- Long-Term Care

- Property & Casualty

Retirement Planning

- Building a Retirement Plan

- Social Security

Income Tax Planning

- Tax Reduction Strategies

- Charitable Contributions

Estate Planning

- Wills & Trusts

- Incapacity Planning